Interim Results for the six months ended 31 July 2025

- Expecting FY 2026 revenue and adjusted PBIT to be ahead and adjusted PBT comfortably ahead of current market expectations(1)

- Recruitment conditions remained positive, with Keystone adding 30 new Principals ongoing growth in Pods

- Interim dividend of 7.5p, reflecting balance sheet strength and confidence in the outlook

Financial Highlights:

- Revenue growth of 16.5% to £54.2 million (H1 2025: £46.5 million)

- Revenue per Principal up 9.9% to £116.8k (H1 2025: £106.3k)

- Adjusted PBIT up 11.2% to £6.2million (H1 2025: £5.6million)

- Adjusted PBT up 20.4% to £7.3 million (H1 2025: £6.1 million) representing an adjusted PBT margin of 13.6% (H1 2025: 13.1%)

- Adjusted basic EPS of 17.8p (H1 2025: 14.6p)

- Cash generated from operations up 10.1% to £6.8 million (H1 2025: £6.2 million) with operating cash conversion of 104.2% (H1 2025: 106%); the Group retains a strong balance sheet with net cash of £6.5 million (H1 2025: £8.3 million) having paid out both final ordinary and special dividend for FY 2025 in the Period.

- Declared interim ordinary dividend of 7.5p per share (H1 2025: 6.2p)

Operational Highlights:

- Consistently strong operational performance continues to deliver high quality, sustainable growth

- Keystone continues to take advantage of positive recruitment market conditions:

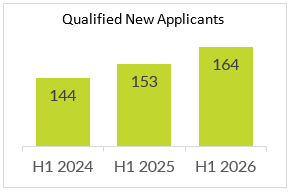

- 164 new applicants in the Period (H1 2025: 153)

- 30 high-calibre new Principals added in the Period bringing total Principals to 472 (31 January 2025: 455), reinforcing Keystone’s brand and market position

- Principals continue to drive growth of Pods with other fee earners increasing 19 in the Period to 140

- Driving forward an AI strategy focused on delivering real value and real-life solutions

- Initiated marketing brand refresh to reflect Keystone’s enhanced position within the legal market

- Continued excellence of service delivery across all the Central office team

Current Trading and Outlook:

- The Group has made a positive start to H2 2026

- The Board are confident in the ongoing success of Keystone and expect revenue and adjusted PBIT for the year ending 31 January 2026 (“FY 2026”) to be ahead of current market expectations, whilst the newly renegotiated interest rates mean that adjusted PBT is expected to be comfortably ahead (1).

(1) Management understands current market expectations for 2026 ahead of this announcement to be revenue £103.6million and adjusted PBIT and adjusted PBT of £12.0million and £12.9million respectively.

James Knight, Chief Executive Officer of Keystone, commented:

“I am delighted that the business continues to deliver such strong operational and financial performance, further reinforcing our ongoing investment in both people and our platform. As we maintain our reputation and leading position as the premier platform law firm, we remain confident that Keystone will continue to attract the high-quality talent needed to drive the business forward, delivering sustainable, long-term profits”.

Chief Executive Officer's Statement

INTRODUCTION AND HIGHLIGHTS

I am delighted to report another strong set of results for the first half of our financial year (“H1 2026” or the “Period”). These results reflect the continued strong performance of the business delivering revenue of £54.2m up 16.5% (H1 2025: £46.5m) and adjusted PBIT(1) of £6.2m up 11.2% (H1 2025: £5.6m). Successful renegotiation of bank interest rates has meant that net interest income has increased to £1.1m (H1 2025: £0.5m) such that reported PBT rose to £6.9m and adjusted PBT(1) increased to £7.3m (increases of 25.0% and 20.4% on H1 2025 results of £5.5m and £6.1m respectively). As always, the cash generative nature of the model has ensured that these profits have converted to cash, with cash generated from operations increasing by 10.1% to £6.8m (H1 2025: £6.2m).

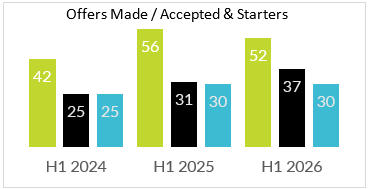

Conditions in the legal recruitment market have continued to be positive for Keystone, as demonstrated by the recruitment KPIs shown in the graphs below:

|

|

H1 2026 saw 30 new Principals join us, bringing the total number of Principals to 472 (31 January 2025: 455), with the total number of fee earners increasing to 612 (31 January 2025: 576). Our continued drive for excellence across all aspects of our business remains at the heart of our recruitment strategy and the calibre of those lawyers who have joined us in the Period is further testament to this.

The central office team has continued to deliver the first-class infrastructure and support our lawyers need to excel. The efforts of our community and engagement team continue to be rewarded, whether that be through the successful onboarding and integration of new lawyers or through the positive feedback we receive from across the lawyer base regarding the thriving community and excellent events we run to bring our people together.

We have recently started a brand refresh project, working with external brand advisers to update our brand imagery so that it aligns more accurately with the law firm we are today and our position within the legal market. This project will continue to run through the second half of this year with implementation anticipated to span the end of this financial year.

For our IT team, the evolution of AI has created an exciting and rapidly evolving area of focus and opportunity. As reported in our last annual report and accounts, the development of this technology within the sector remains in its infancy, however, it is evolving extremely rapidly. Most legal IT tools now claim to include some elements of AI and there are also a substantial number of new entrants to the market, all promising an AI revolution. As in everything we do, our AI strategy is focused on delivering real value, providing real-life solutions to challenges experienced by our lawyers and / or central office team and bringing efficiencies and enhanced user experience across the business.

During the Period, we have rolled out a number of generative AI tools, which are available as extensions to the market leading products we already provide to our lawyers. These include the ability for our lawyers to produce file notes of Teams meetings in seconds and for our lawyers to use generative AI solutions across any documents held within NetDocuments (our secure cloud-based document management system). We have developed an internal tool using generative AI as well as an element of agentic AI. This enables our lawyers to interrogate our voluminous Operating Manual using basic English language queries providing them with logical answers as well as links to the relevant sections of the manual; taking only seconds. We have also worked with expert external consultants to identify areas where the deployment of bespoke agentic AI agents could deliver efficiency and enhance user experience across the business. We are now reviewing the output from this work in order to prioritise development and implementation which we anticipate will commence later this year. We continue to explore the market, testing other market leading products and considering what value these may bring to our lawyers.

I would like to take this opportunity to thank my colleagues across all teams of the central office for their dedication and passion, which continues to drive the business forwards and has made these results possible.

Dividend

I am pleased to announce that the Board has declared an interim ordinary dividend of 7.5p per share. This dividend will be payable on 24 October 2025 to shareholders on the register on 3 October 2025, and the shares will go ex-dividend on 2 October 2025.

Summary and outlook

We are delighted with the overall success of H1 2026 results. Keystone has produced another strong performance delivering high quality, sustainable growth, driving the business forwards and reasserting our position as market leader.

Although there remains global economic uncertainty, from which the UK is not exempt, we remain positive in the ongoing success of Keystone. In light of the success of our H1 2026 performance, together with the positive start we have had to H2 2026, the Board now expects that Keystone will deliver both revenue and adjusted PBIT, for FY 2026, ahead of current market expectations(2),whilst the ongoing benefit of the renegotiated bank interest rates means that adjusted PBT will be comfortably ahead of current market expectations.

James Knight

Chief Executive Officer

22 September 2025

(1) Adjusted PBIT and adjusted PBT are calculated using profit before tax and adding back amortisation in the prior period and share-based payments for all periods.

(2) Management understands current market expectations for FY 2026 to be revenue of £103.6m and adjusted PBIT and adjusted PBT of £12.0m and £12.9m respectively.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 31 July 2025

|

Note |

6 months to July 2025 |

6 months to July |

Revenue |

|

54,151,537 |

46,468,026 |

Cost of sales |

|

(40,358,020) |

(34,383,352) |

Gross profit |

|

13,793,517 |

12,084,674 |

Trade receivables impairment |

|

(265,266) |

(255,217) |

Corresponding reduction in trade payables |

|

180,059 |

177,885 |

|

|

(85,207) |

(77,332) |

Depreciation and amortisation |

|

(346,456) |

(447,286) |

Share-based payments |

2 |

(408,852) |

(378,934) |

Administrative expenses |

2 |

(7,211,696) |

(6,194,844) |

Other operating income |

|

43,461 |

28,710 |

Operating profit |

|

5,784,767 |

5,014,988 |

Finance income |

|

1,578,727 |

929,379 |

Finance costs |

|

(431,834) |

(400,167) |

Profit before tax |

|

6,931,660 |

5,544,200 |

Corporation tax expense |

|

(1,724,898) |

(1,492,880) |

Profit and total comprehensive income for the period attributable to equity holders of the Parent |

|

5,206,762 |

4,051,320 |

Basic EPS (p) |

1 |

16.5 |

12.9 |

Diluted EPS (p) |

1 |

16.2 |

12.6 |

The above results were derived from continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 July 2025

|

Note |

31 July 2025 |

31 July 2024 |

31 January 2025 |

Assets |

|

|

|

|

Non-current assets |

|

|

|

|

Property, plant and equipment |

|

|

|

|

– Owned assets |

|

690,053 |

80,028 |

772,027 |

– Right-of-use assets |

|

1,741,680 |

2,206,259 |

1,973,730 |

Total property, plant and equipment |

|

2,431,733 |

2,286,287 |

2,745,757 |

Intangible assets |

|

4,807,411 |

4,880,512 |

4,807,411 |

Investments |

|

129,350 |

129,350 |

129,350 |

|

|

7,368,494 |

7,296,419 |

7,682,518 |

Current assets |

|

|

|

|

Trade and other receivables |

3 |

30,043,484 |

27,270,682 |

28,325,545 |

Corporation tax |

|

– |

29,899 |

– |

Cash and cash equivalents |

|

6,505,516 |

8,311,102 |

9,687,172 |

|

|

36,549,000 |

35,611,683 |

38,012,717 |

Total assets |

|

43,917,494 |

42,907,832 |

45,695,235 |

Equity and liabilities |

|

|

|

|

Equity |

|

|

|

|

Share capital |

|

63,434 |

63,186 |

63,186 |

Share premium |

|

9,920,760 |

9,920,760 |

9,920,760 |

Share-based payments reserve |

|

968,590 |

874,353 |

1,276,080 |

Retained earnings |

|

5,827,556 |

6,562,760 |

9,102,454 |

Equity attributable to equity holders of the Parent |

|

16,780,340 |

17,421,058 |

20,362,480 |

Non-current liabilities |

|

|

|

|

Lease liabilities |

|

1,320,595 |

1,762,833 |

1,563,376 |

Deferred tax liabilities |

|

– |

14,610 |

– |

Provisions |

|

1,198,130 |

912,071 |

1,162,235 |

|

|

2,518,725 |

2,689,514 |

2,725,611 |

Current liabilities |

|

|

|

|

Trade and other payables |

|

23,942,119 |

22,202,412 |

21,985,238 |

Lease liabilities |

|

594,848 |

594,848 |

594,848 |

Corporation tax liability |

|

81,462 |

– |

27,058 |

|

|

24,618,429 |

22,797,260 |

22,607,144 |

Total liabilities |

|

27,137,154 |

25,486,773 |

25,332,755 |

Total equity and liabilities |

|

43,917,494 |

42,907,832 |

45,695,235 |

The interim statements were approved and authorised for issue by the Board of Directors on 22 September 2025 and were signed on its behalf by:

A Miller

Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 31 July 2025

|

Attributable to equity holders of the Parent |

||||

Share capital |

Share premium |

Share-based payment reserve |

Retained earnings |

Total |

|

At 31 January 2024 (audited) |

62,963 |

9,920,760 |

1,059,531 |

5,896,437 |

16,939,691 |

Profit for the period and total comprehensive income |

– |

– |

– |

4,051,320 |

4,051,320 |

Transactions with owners |

|

|

|

|

|

Share-based payments vesting |

223 |

– |

(564,113) |

564,113 |

223 |

Share-based payments awards |

– |

– |

378,964 |

– |

348,964 |

Dividends paid |

– |

– |

– |

(3,949,109) |

(3,949,109) |

At 31 July 2024 (unaudited) |

63,186 |

9,920,760 |

874,353 |

6,562,760 |

17,421,058 |

Profit for the period and total comprehensive income |

– |

– |

– |

4,498,453 |

4,498,453 |

Transactions with owners |

|

|

|

|

|

Share-based payments vesting |

– |

– |

– |

– |

– |

Share-based payments awards |

– |

– |

401,698 |

– |

401,698 |

Dividends paid |

– |

– |

– |

(1,958,760) |

(1,958,760) |

At 31 January 2025 (audited) |

63,186 |

9,920,760 |

1,276,080 |

9,102,454 |

20,362,480 |

Profit for the period and total comprehensive income |

– |

– |

– |

5,206,762 |

5,206,762 |

Transactions with owners |

|

|

|

|

|

Share-based payments vesting |

248 |

– |

(716,342) |

716,343 |

248 |

Share-based payments awards |

– |

– |

408,852 |

– |

408,852 |

Dividends paid |

– |

– |

– |

(9,198,002) |

(9,198,002) |

At 31 July 2025 (unaudited) |

63,434 |

9,920,760 |

968,590 |

5,827,556 |

16,780,340 |

CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 31 July 2025

|

Note |

6 months to July 2025 |

6 months to July |

Year ended 31 January 2025 |

Cash flows from operating activities |

|

|

|

|

Profit before tax |

|

6,931,660 |

5,544,200 |

11,684,999 |

Adjustments to cash flows from non-cash items |

|

|

|

|

Depreciation and amortisation |

2 |

346,056 |

447,286 |

823,681 |

Share-based payments |

|

408,852 |

378,934 |

780,662 |

Finance income |

|

(1,578,727) |

(929,379) |

(1,966,246) |

Finance costs |

|

431,834 |

400,167 |

855,043 |

|

|

6,539,675 |

5,841,208 |

12,178,139 |

Working capital adjustments |

|

|

|

|

(Increase) in trade and other receivables |

(1,717,939) |

(2,076,333) |

(3,131,196) |

|

Increase in trade and other payables |

1,956,881 |

2,419,825 |

2,202,651 |

|

Increase in provisions |

|

35,895 |

4,126 |

254,290 |

Cash generated from operations |

|

6,814,512 |

6,188,826 |

11,503,884 |

Interest paid on client balances |

|

(377,191) |

(370,980) |

(767,002) |

Interest portion of lease liability |

|

(54,643) |

(29,187) |

(88,041) |

Corporation taxes paid |

|

(1,670,492) |

(2,800,524) |

(4,404,523) |

Cash generated from operating activities |

4,712,186 |

2,988,135 |

6,244,318 |

|

Cash flows from/(used in) investing activities |

|

|

|

|

Interest received |

|

1,578,727 |

929,379 |

1,966,246 |

Purchases of property, plant and equipment |

(32,432) |

(9,609) |

(772,373) |

|

Net cash generated from/(used in) investing activities |

1,546,295 |

919,770 |

1,193,873 |

|

Cash flows from financing activities |

|

|

|

|

Proceeds from issue of ordinary shares |

|

248 |

223 |

223 |

Lease repayments |

|

(251,383) |

(14,989) |

(210,445) |

Dividends paid |

|

(9,189,002) |

(3,949,109) |

(5,907,869) |

Net cash (used in) financing activities |

(9,440,137) |

(3,963,875) |

(6,118,091) |

|

Net (decrease)/increase in cash and cash equivalents |

|

(3,181,656) |

(55,970) |

1,320,100 |

Cash at 1 February |

|

9,687,172 |

8,367,072 |

8,367,072 |

Cash at 31 July |

|

6,505,516 |

8,311,102 |

9,687,172 |